Preparing for tax season seems to be a season itself. As accountants are busy with tax planning, other business units have their own checklists and planning to do, not the least of which is IT. As IT completes year-end project work, they are also gearing up for the increased workloads that tax Season brings. The good news is – you do not have to do it alone. If you have the right IT partner / vendor, they can certainly take some of the load and help you prepare for a successful year.

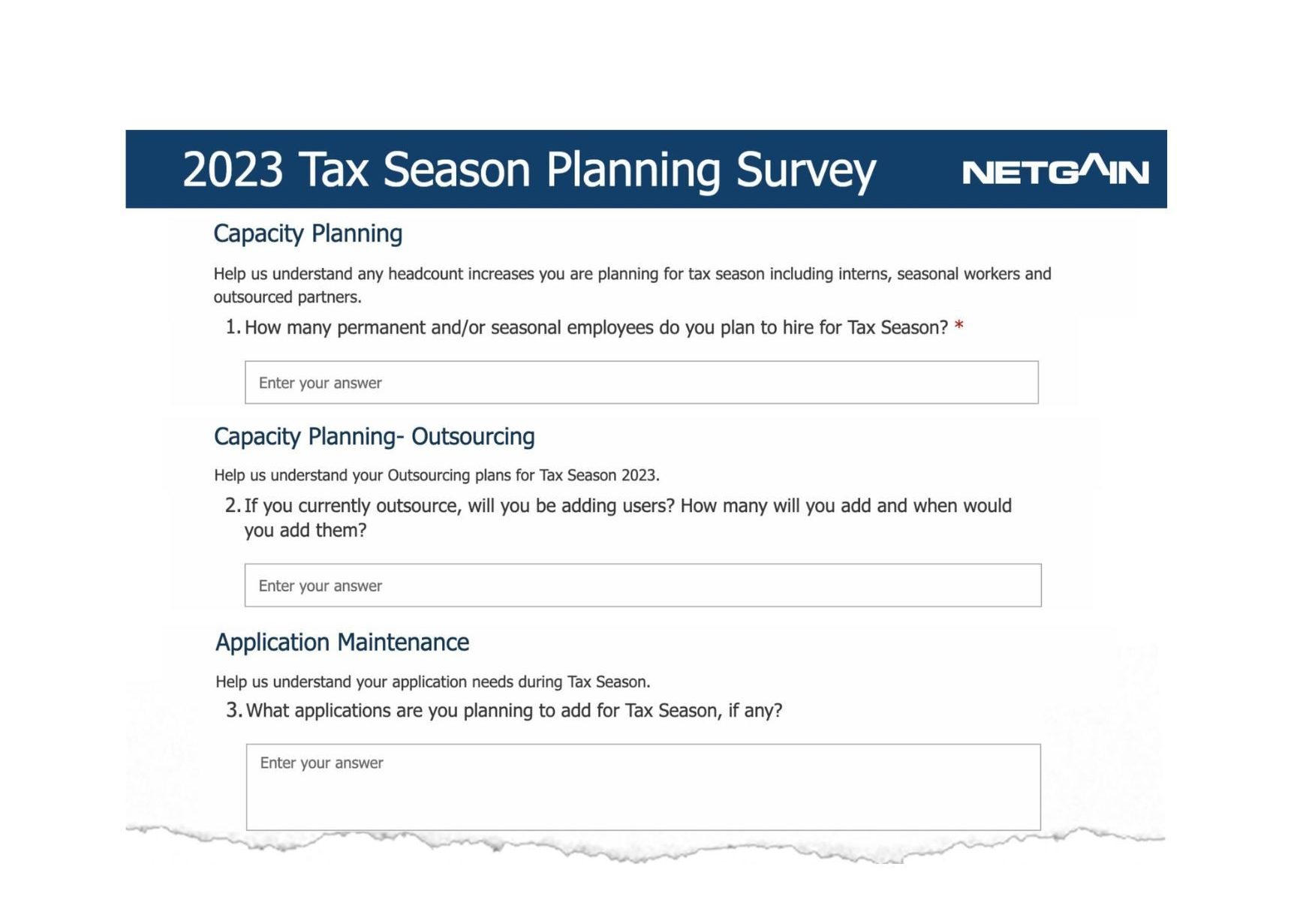

We work with our CPA clients on a day-to-day basis and are acutely aware of their needs and concerns throughout the year, especially during busy season. To stay one step ahead of tax season preparation, we survey our clients to find out how we can best support them for a successful tax season. This is a proactive way for us to help our clients prepare for any changes their firm anticipates so that together we can give them the best possible experience.

Here we share 5 considerations from our experience to help you prepare for tax season:

- Plan for seasonal / additional employees early: Communicate hiring plans to your IT partner as early as you can. Even if you do not have a final count, an estimate can help you prepare for infrastructure changes needed to best support your users.

- Provide proactive, reliable support for your firm: At any moment, time-sensitive needs can arise. Keeping your IT partner informed will allow you to maintain efficiency in your business and reduce downtime or productivity loss. In turn, your IT partner should also be responsive in acknowledging your needs to best support your firm.

- Ensure proper management of critical applications: Timely management of critical application updates is an essential part of a good tax season. Your IT partner should be effectively managing this process with your direction. Communicating maintenance windows and scheduled downtime helps your firm maximize productivity throughout the season.

- Consider the offshore user experience:

- After–hours support needs – Ensure that your support team is equipped to meet the demands of a 24/7 operation. Downtime for your outsourced group means a loss of productivity and ROI on the investment.

- Environment updates – Plan for your application update schedule and the communication process around it. While many firms prefer overnight updates, that is not always possible and may interfere with outsourced workers across the globe. Establish a communication plan before tax season so your users know how normal and emergency maintenance windows will be communicated throughout tax season.

- Practice a security-first mindset: Bad actors do not stop their pursuits because it is your busy season. In fact, it is quite the contrary. Bad actors will work harder to capitalize on distractions and attempt to catch you and your users off guard.

- Remain vigilant about cybersecurity.

- Create a human firewall by training your users to stop, think, and ask to help prevent a malicious attack.

- Strengthen your defense by aligning with an IT partner who actively practices a security-first mindset. Your IT partner should reinforce your security front so you and your firm can focus on executing at your best during tax season.

While these considerations should be top of mind when initially aligning with an IT partner, tax season is truly the time to ensure they are ready to support you in the most critical ways. If your partnership has misaligned communication and expectations, your firm could face serious setbacks at the worst possible time for your business. The considerations above provide a rough outline of what you and your IT partner should tackle together in preparation for the busy season.

At Netgain, our team of technical experts know that you do not need more things on your plate, especially at this time of year. We are here for you every step of the way, so your firm can remain focused on business needs and productivity. We provide a secure, performant, and consistent environment to support our clients during and after-tax season.